The Cotton Boll Conspiracy

Out of the South cometh the whirlwind

Signalife, a one-time darling of the South Carolina media, would be categorized by most investment analysts as a penny stock, and the difficulty in tracking down information about the company points to some of the problems inherent in following a penny stock company.

Singalife was a Greenville, SC-based medical device company until the middle of last year, when it apparently relocated to Studio City, Calif. It’s not certain when the move took place because Signalife doesn’t appear to have issued a formal statement regarding the move. Once known as Recom Managed Systems, it had moved to downtown Greenville in 2005.

The only way one can tell there was a change in headquarters is the fact that in May of last year the company listed its base of operations on an SEC filing as being Greenville, while two months later it was using Studio City, outside Los Angeles, as its headquarters on information sent to the Securities and Exchange Commission.

The move may have coincided with Lowell Harmison, president and chief executive officer, leaving the company in either late May or early June 2008, but again it’s difficult to tell because the company filed no information with the Securities and Exchange Commission. Typically, public companies file documents with the SEC when there’s a significant change in management.

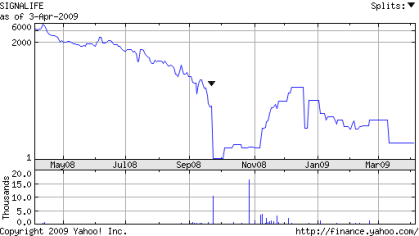

Signalife was delisted from the American Stock Exchange last September. On Sept. 19, 2008, it effected a 1-for-4,500 reverse stock split and began trading on the OTC Bulletin Board. That means if you had 90,000 shares of the old Signalife stock, you wound up with 20 shares of new stock.

According to Yahoo! Finance, in the past 52 weeks, Signalife stock has fluctuatedfrom a high of more than $6,600 a share to a low of $1 a share. It current trades at $4.50.

In November, it announced it would change its name to HeartTronics, Inc., and named former National Football League standout Willie Gault co-chief executive officer. It doesn’t appear any formal filing was made with the SEC regarding the name change, although the company did issue a press release.

In February, Heartronics ended its relationship with SC-based auditing firm Elliott Davis. At the same time, interim chief financial officer Kevin Pickard left the company. In addition, other directors have departed over the past year.

For the nine months ended Sept. 30, 2008, the company lost $11.7 million and, according to an SEC filing “incurred losses since inception resulting in an accumulated deficit of $60,423,275.”

The company added that its financial difficulties “raise substantial doubts about the company’s ability to continue.”

Just last week, the company told the SEC that it would not be able to file its 2008 10-K annual report by the March 31, 2009, deadline.

Unfortunately, little of this would have been gleaned from reading The Greenville News or other SC newspapers. These days, the media’s idea of business coverage appears to involve little more than rewriting company press releases when good news is put out.

More importantly, trying to keep tabs on Signalife/HeartTronics over the past year illustrates perfectly the importance of Rule No. 1 when dabbling in penny stocks: Caveat emptor.

No comments:

Post a Comment